Unlock the Perks of Engaging Financial Obligation Expert Solutions to Browse Your Path Towards Debt Relief and Financial Flexibility

Engaging the solutions of a debt professional can be an essential step in your journey in the direction of accomplishing financial debt relief and economic stability. The inquiry continues to be: what particular benefits can a financial debt specialist bring to your financial scenario, and exactly how can you identify the appropriate companion in this venture?

Comprehending Financial Debt Expert Solutions

Financial debt consultant solutions provide specialized advice for people grappling with economic difficulties. By assessing your earnings, financial debts, and expenses, a debt consultant can help you identify the root triggers of your monetary distress, permitting for an extra accurate approach to resolution.

Financial debt professionals generally employ a multi-faceted approach, which may include budgeting assistance, negotiation with financial institutions, and the growth of a strategic payment plan. They act as middlemans between you and your creditors, leveraging their expertise to negotiate a lot more desirable terms, such as minimized rates of interest or prolonged payment timelines.

Furthermore, financial debt consultants are furnished with current understanding of pertinent legislations and laws, ensuring that you are informed of your rights and options. This professional guidance not only eases the psychological worry connected with debt however likewise encourages you with the devices needed to gain back control of your economic future. Ultimately, engaging with financial debt specialist solutions can bring about a more enlightened and organized course towards monetary security.

Key Benefits of Expert Assistance

Involving with financial debt consultant solutions provides various advantages that can significantly boost your financial situation. Among the main advantages is the expertise that professionals offer the table. Their comprehensive expertise of debt management techniques permits them to customize remedies that fit your one-of-a-kind conditions, guaranteeing an extra reliable method to attaining economic security.

Additionally, financial obligation experts frequently offer arrangement assistance with lenders. Their experience can bring about extra desirable terms, such as minimized rate of interest or settled financial obligations, which might not be possible with direct arrangement. This can cause significant monetary alleviation.

In addition, experts provide an organized prepare for payment, aiding you prioritize financial obligations and assign sources successfully. This not just simplifies the repayment procedure yet likewise fosters a feeling of accountability and progress.

Ultimately, the combination of specialist assistance, settlement abilities, structured payment strategies, and psychological support placements financial obligation specialists as important allies in the search of financial obligation alleviation and monetary liberty.

Just How to Choose the Right Specialist

When selecting the appropriate financial obligation consultant, what essential aspects should you take into consideration to make certain a favorable end result? First, assess the specialist's credentials and experience. debt consultant services singapore. Seek certifications from recognized companies, as these show a degree of professionalism and understanding in financial debt administration

Next, think about the professional's credibility. Research on-line reviews, reviews, and rankings to assess previous customers' complete satisfaction. A strong record of successful financial obligation resolution is essential.

Furthermore, assess the expert's method to debt monitoring. An excellent professional should provide tailored solutions customized to your special monetary circumstance rather than a one-size-fits-all remedy - debt consultant services singapore. Transparency in their processes and fees is essential; ensure you comprehend the prices included prior to committing

Interaction is one more key variable. Select an expert that is eager and approachable to address your concerns, as a solid working partnership can enhance your experience.

Typical Financial Debt Relief Methods

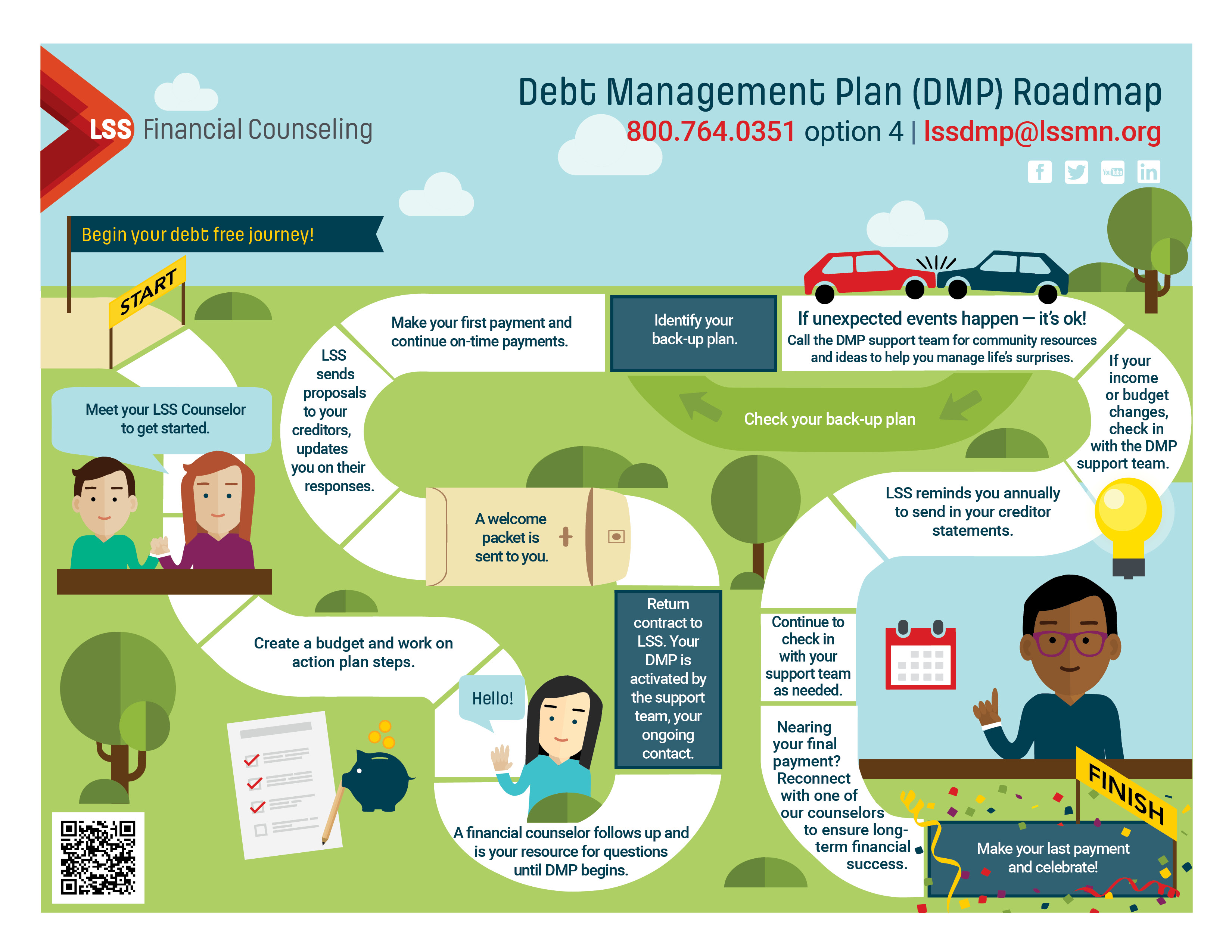

While numerous financial debt relief methods exist, selecting the right one relies on private monetary scenarios and objectives. Some of one of the most common approaches include debt consolidation, debt management plans, and financial obligation negotiation.

Debt debt consolidation entails incorporating numerous debts right into a single lending with a reduced rates of interest. This method simplifies settlements and can reduce month-to-month responsibilities, making it easier for people to regain control of their financial resources.

Financial obligation monitoring plans (DMPs) are created by credit history therapy companies. They bargain with lenders to reduced interest prices and produce a structured repayment plan. This choice enables individuals to repay financial debts over a fixed period while taking advantage of expert support.

Financial obligation negotiation entails bargaining directly with lenders to resolve debts for much less than the pop over to this site complete amount owed. While this technique can give immediate relief, it might influence credit history and typically entails a lump-sum settlement.

Lastly, insolvency is a lawful alternative that can provide remedy for frustrating financial debts. Nonetheless, it has long-term financial ramifications and must be taken into consideration as a last resource.

Selecting the proper method calls for mindful evaluation of one's financial situation, guaranteeing a tailored approach to accomplishing long-lasting stability.

Actions In The Direction Of Financial Freedom

Next, establish a realistic budget that prioritizes essentials and fosters savings. This budget should include provisions for debt repayment, permitting you to allot excess funds properly. Adhering to a budget plan assists top article cultivate disciplined spending behaviors.

As soon as a spending plan remains in location, consider involving a financial debt expert. These experts provide tailored approaches for handling and minimizing debt, providing understandings that can accelerate your journey towards monetary freedom. They may advise choices such as debt loan consolidation or settlement with creditors.

Furthermore, emphasis on building an emergency situation fund, which can prevent future monetary pressure and offer tranquility of mind. Together, these steps develop a structured method to attaining financial flexibility, changing aspirations into fact.

Conclusion

Engaging financial debt consultant services supplies a strategic method to attaining debt relief and monetary liberty. These professionals offer crucial guidance, tailored techniques, and psychological assistance while ensuring compliance with relevant legislations and guidelines. By focusing on financial debts, negotiating with creditors, and executing structured payment strategies, people can reclaim control over their economic scenarios. Ultimately, the competence of financial obligation specialists substantially boosts the chance of browsing the complexities of financial obligation monitoring properly, bring about an extra safe and read this article secure economic future.

Involving the solutions of a debt consultant can be a crucial step in your journey in the direction of accomplishing debt alleviation and financial security. Financial obligation consultant solutions provide specialized guidance for people grappling with financial obstacles. By evaluating your revenue, financial obligations, and expenses, a financial debt specialist can aid you determine the root triggers of your financial distress, enabling for an extra precise strategy to resolution.

Engaging financial debt specialist solutions offers a calculated approach to accomplishing debt relief and economic freedom. Eventually, the proficiency of financial obligation professionals considerably boosts the likelihood of navigating the intricacies of financial debt management successfully, leading to an extra protected monetary future.